How Hedging Can Help Farmers Reduce Loss From Low Prices

go.ncsu.edu/readext?963889

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲Planting a crop requires substantial up-front investment, yet the farmer will not know how much they will earn until the crop is sold. If the price can be set in advance, then the farmer would know more about their potential income. This video explains how farmers can use hedging to do this.

How Does Hedging Work?

Hedging for grain crops uses a futures contract to bridge the gap between planting time and harvest time by acting as a substitute for the sale until the grain in the field is ready to be harvested and sold. Here are the steps the farmer would take to hedge:

Step 1: Placing the Hedge

The hedging process begins early in the growing season, some time after planting but months before harvest. The farmer goes to a buyer, typically through a futures exchange like the Chicago Mercantile Exchange (CME), and sells a contract. The farmer and buyer agree on the price that will be paid at harvest time.

Step 2: Lifting the Hedge

After selling a contract the farmer is legally obligated to deliver grain after harvest. There are two options they can take to lift the hedge at this point.

Option 1: He or she can meet this obligation by delivering as agreed in the futures contract. The farmer will receive the price at which they sold the futures contract, no matter what current prices are. When using the futures market to hedge a crop the delivery location for grain is typically somewhere in the midwest. Delivering 1 contract (5000 bushels) to the midwest will cost the farmer money in shipping costs, so this option is rarely chosen.

Option 2: If the farmer does not want to deliver grain to the specified location, they can offset the commitment by returning to the futures exchange and purchasing back the same contract. The farmer is no longer obligated to deliver to the midwest and can now sell their grain locally. In this case, gains or losses from the futures market will cancel out the lower or higher price they receive from selling their crop to a local buyer.

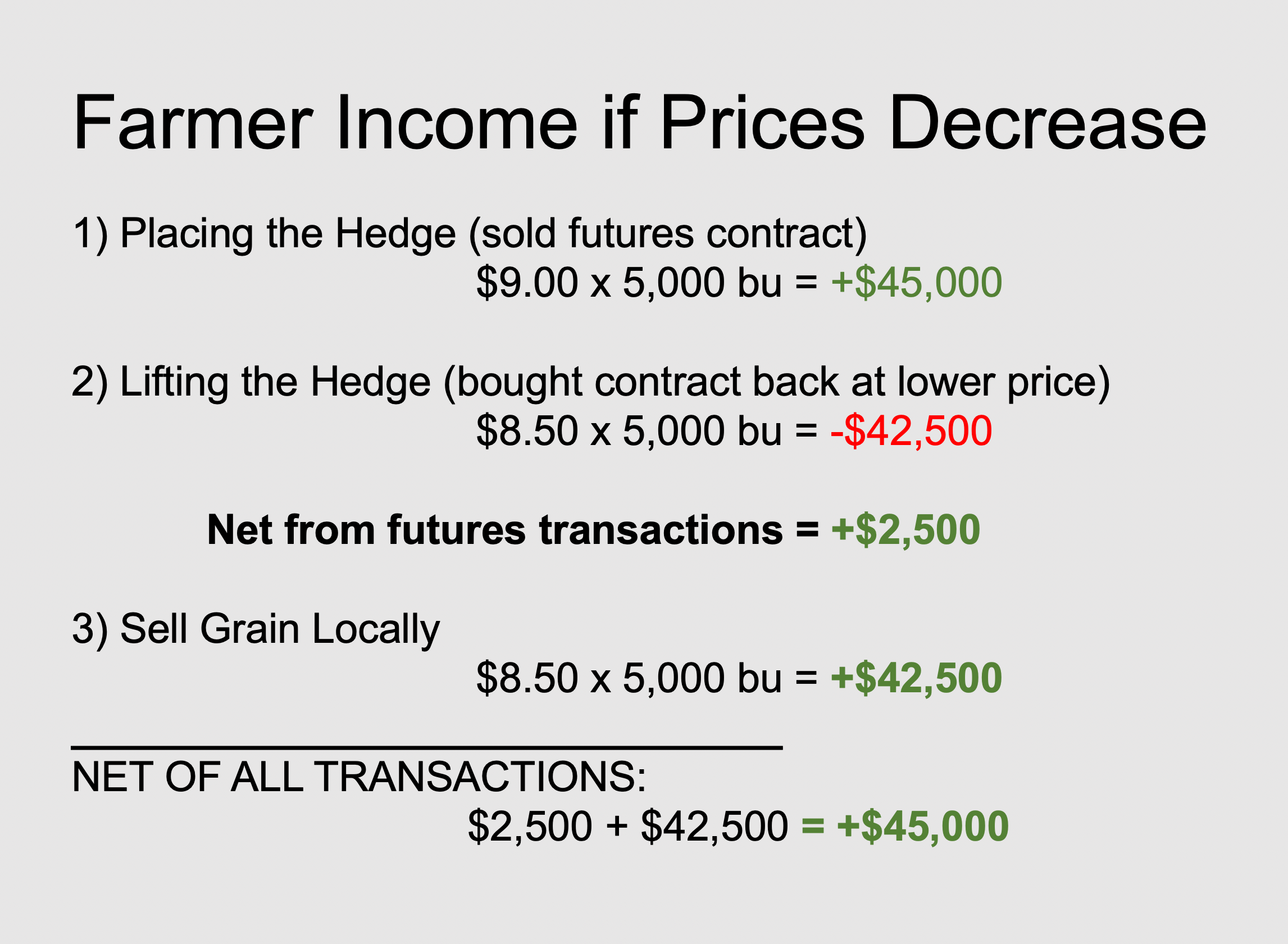

For example, if prices decline 50 cents per bushel between when the farmer placed the hedge and when they lifted the hedge, they profit 50 cents from the futures transactions but receive a price for the physical grain that is 50 cents per bushel lower than at the time the hedge was placed:

In the above example the farmer profited $2,500 from the futures transactions and also $42,500 from selling their grain to a local elevator. The combined total of both the futures transactions and the local sale is $45,000 for the 5,000 bushels.

It is important to note that there are always costs to reducing risk, sometimes these are obvious in the case of fees or the cost of shipping to the midwest in the rare case of higher grain prices. But the type of costs will depend on the hedging tool. For a futures contract hedge there are details of the futures marketplace which are important considerations – for example, while the hedge is in place, the farmer is required to hold cash in a futures margin account.

There are many ways to hedge, at its core hedging is about risk management. For this reason, a successful hedge will not necessarily increase revenue, but it will reduce potential losses.

This project is funded by the NC Small Grain Growers Association. For more information on NC wheat visit the North Carolina Small Grain Growers Association.